Would you like to earn some extra cash working from home in your spare time? [click here to keep reading]

Learn How CPA Firms View a Gap in Your Resume

Many accountants go into a death spiral when discussing during an interview why they left or got fired. Newsflash: no one cares. Here is the bottom line, on resume gaps and more. [click to keep reading…]

Many accountants go into a death spiral when discussing during an interview why they left or got fired. Newsflash: no one cares. Here is the bottom line, on resume gaps and more. [click to keep reading…]

Work in a CPA Firm Tax Department? Plan for Change.

Many current and future tax CPAs think they can control the flow of their careers when in most cases they are merely in the eye of the hurricane. But that doesn’t mean you’re without options. [click to keep reading…]

Many current and future tax CPAs think they can control the flow of their careers when in most cases they are merely in the eye of the hurricane. But that doesn’t mean you’re without options. [click to keep reading…]

Accounting LIONs

If you have followed my blog for a while you are aware that I created a LinkedIn group with the same name as my blog titled Advice for Tax Preparers. That group is devoted to the same premise as my blog in that the group provides accounting students and tax professionals the opportunity the learn, share and discuss tips and tricks on how to succeed as a tax preparer in a public accounting firm.

I have now created a new LinkedIn group called Accounting LIONs which goes in a completely different direction. This group solves a big problem for accounting students and accounting professionals who want to expand their accounting and tax professional connections on LinkedIn, but do not know enough people or have the time to do it. [click to keep reading]

Interviews to Help Tax Preparers

As part of my blog Advice for Tax Preparers, I will be adding interviews other tax professionals on their advice, tips, and tricks to make your life as a tax preparer easier and more successful. My intent is to get a wide range of interviews from tax professionals in terms of their experience and part of the country so that you can get an understanding of which issues are common in public accounting firm tax departments versus which issues depend on your situation or part of the country. [click to keep reading…]

Learn Why New Accounting Staff Eat Time & How to Fix The Problem

Accountants by the nature of our profession want to follow rules. Therefore, we like it when we have guidelines such as an employee handbook that tell us how to respond in an accounting firm to a particular situation. However, new accountants soon find out that the firm grapevine provides unwritten rules to be followed as well. One example is in the area of the billable hours (the time each person charges to the job for preparing and reviewing the tax return or audit) that a staff should put on his timesheet. If the staff person talks to people in the firm they will get one or more of the following answers: [click to keep reading…]

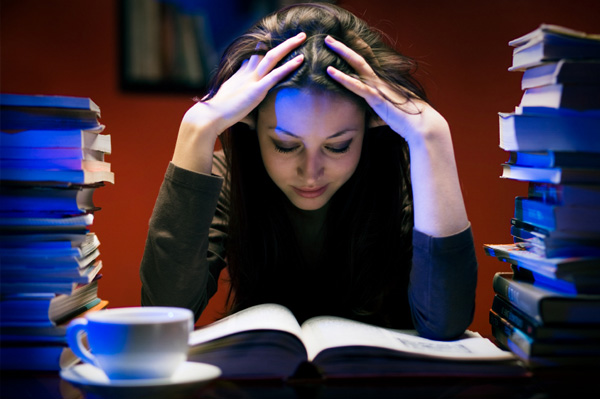

Why Should You Take a CPA Exam Review Course?

I recently published an article with several tips to help people pass the CPA exam. (See 4 Tips from a 20 Year CPA to Pass the CPA Exam). One of the tips I mentioned in the article was that they should take a review course for at least auditing, but I believe they should take one for all of the courses. Most of the responses I received on that point were positive, but I had one person ask me why anyone should bother taking a review course. They noted that they had bought a couple of review books and some test questions and done just fine on the CPA exam. I figured that there might be others who felt the same way so I thought I would do a post on the topic. [click to keep reading…]

I recently published an article with several tips to help people pass the CPA exam. (See 4 Tips from a 20 Year CPA to Pass the CPA Exam). One of the tips I mentioned in the article was that they should take a review course for at least auditing, but I believe they should take one for all of the courses. Most of the responses I received on that point were positive, but I had one person ask me why anyone should bother taking a review course. They noted that they had bought a couple of review books and some test questions and done just fine on the CPA exam. I figured that there might be others who felt the same way so I thought I would do a post on the topic. [click to keep reading…]

How to Get an Accounting Job Using LinkedIn

This is the big one isn’t it? Most of us get plenty of articles in our inbox and social media from sources such as Accounting Today, CPA Trendlines, Going Concern, AccountingWeb, Journal of Accountancy, etc., on the latest updates in the profession. But we are really only looking for a few things.

This is the big one isn’t it? Most of us get plenty of articles in our inbox and social media from sources such as Accounting Today, CPA Trendlines, Going Concern, AccountingWeb, Journal of Accountancy, etc., on the latest updates in the profession. But we are really only looking for a few things.

- How do I get my first accounting job?

- How do I make my current job easier?

- What do I need to do to get promoted?

- Can I quit and get a better job or move to a better CPA firm?

Learn How CPA Firms Will Increase Their Net Income on 1040 Tax Returns Without Raising Fees or Reducing Expenses.

One of the constant problems for CPA firms with individual clients is getting all of their information in time to prepare, review and file their return before the October 15th deadline no matter how many times they are asked for their information. I once worked at a firm that had an individual client that was the last tax return the firm filed by the October 15th deadline three years in a row.

When clients delay providing their personal tax information until after August 1st, the extra time and expense spent on the tax return can turn a profitable job into a loss for the firm. At a minimum, the client has forced the firm to use “tax season” time to prepare a return that could have been completed in June or July.

In a good economy, the firm might charge the client for the additional time (or use of tax season time) and effort spent on the tax return. But since the economy has been bad for several years, clients have become highly resistant to material price increases. In addition, the economy has caused many clients to see the creation of their tax return as a product rather than a service. Therefore, they simply do not see the difference in which CPA firm prepares their personal tax return. [click to keep reading…]

4 Tips from a 20 Year CPA on Passing the CPA Exam

As noted in the title, I have worked on the tax side of the public accounting business for over twenty years. The part not in the title is that I am the second generation of my family to work in public accounting. My father has been in the business for over forty years. Therefore, between the two of us, we have seen decades of tax and audit staff passing and failing the exam. Although there are plenty of places to learn about the subject matter of each exam section, I wanted to pass along a few points you might not hear from other people. [click to keep reading….]

As noted in the title, I have worked on the tax side of the public accounting business for over twenty years. The part not in the title is that I am the second generation of my family to work in public accounting. My father has been in the business for over forty years. Therefore, between the two of us, we have seen decades of tax and audit staff passing and failing the exam. Although there are plenty of places to learn about the subject matter of each exam section, I wanted to pass along a few points you might not hear from other people. [click to keep reading….]

The Definition of a Secret in a Public Accounting Firm Tax Department

I could not find who originally said it. But the following quote is one that I heard from a management consultant friend of mine on a regular basis. He said the definition of a secret is

“merely information that is passed one person at a time”.

His point was that any information you give or action you take in front of anyone at the firm is at risk of being communicated to another person in the firm. It does not matter if the information is personal or professional or if the information was given accidentally or on purpose.

Breaking the Rules

I know that you are going to break the rule I just noted to you. All of us do it at one time or another. We form friendships with our coworkers and we want to talk with them about our personal and professional lives.

But keep in mind that every time you do it, you need to consider the following questions: [click to keep reading…]

Tax Preparers: Learn about Four Professions that Create Problem Clients for CPA firms.

Tax accountants might work with numbers, but we are in a people business. You will run into good and bad clients in all professions. But the following professions tend to cause CPA firms more grief on average than others. If you are assigned a client in one of these area then look at the prior year files to see if the client tends to cause a problem for the firm. [click to keep reading…]

Tax accountants might work with numbers, but we are in a people business. You will run into good and bad clients in all professions. But the following professions tend to cause CPA firms more grief on average than others. If you are assigned a client in one of these area then look at the prior year files to see if the client tends to cause a problem for the firm. [click to keep reading…]

Accounting Majors: The Three Tax Books Used by CPA Firms Every Day that Colleges Do Not Give You

College tax textbooks do provide good information. But they are rarely used in a public accounting firm’s tax department. The reason is that these books are usually designed to discuss basic tax theory rather than to discuss the day-to-day items that you will run into in a typical public accounting tax practice. Therefore, a tax textbook has the luxury of spending several chapters discussing tax reorganizations even if you might not see one for the first several years of your career (if at all).

But in the real world, you want practical tax information that is easily accessed. You want to know what specific types of medical expenses are deductible on Form 1040 Schedule A or real estate expenses on Form 1040 Schedule E. Yes, there are times when you want to research a difficult topics. But on most occasions, the issue of whether an item is deductible or includible in income has already been decided. You only need to find the answer (in plain easy to read English).

As a result, there are three tax books that have been created to solve this problem that are used daily in a public accounting firm’s tax department. [click to keep reading…]

Tax Preparers: A Free Program to Stop Losing Important Notes

How many times have you written down a quick note or phone number from your boss or client and then you can’t find it? The answer is too many. It can drive you crazy. Most tax preparers have used paper Post-it Notes to leave a reminder for family, friends or even ourselves. But we know that Post-it notes can be a problem in a public accounting firm. By design they are very flimsy and easy to lose. The phone number that was given to you by your boss or client is now buried below a stack of files that you put on top it. Yes, you might find the number eventually. But you want to call that person now. [click to keep reading…]

How many times have you written down a quick note or phone number from your boss or client and then you can’t find it? The answer is too many. It can drive you crazy. Most tax preparers have used paper Post-it Notes to leave a reminder for family, friends or even ourselves. But we know that Post-it notes can be a problem in a public accounting firm. By design they are very flimsy and easy to lose. The phone number that was given to you by your boss or client is now buried below a stack of files that you put on top it. Yes, you might find the number eventually. But you want to call that person now. [click to keep reading…]

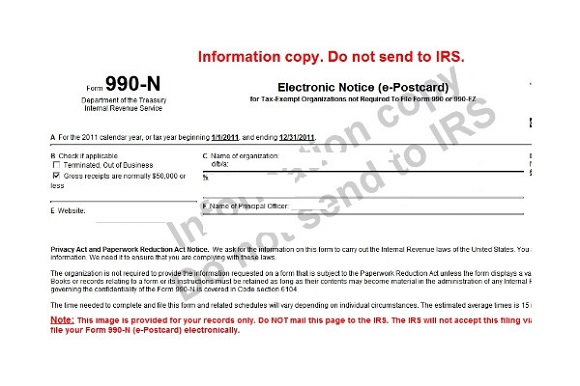

Learning How to Get the IRS to Waive a Nonprofit Late Filing Penalty

It’s going to happen. At some point, you or your boss is going to get the following sob story from a client.

Dear My Favorite CPA (when its starts this way you know you are in trouble – heh),

I know that you only prepare my individual and business tax returns. But I really need your help. I am on the board of directors of a charity that just got an IRS notice which says we owe them $30,000!!!

We did not discover until recently that the prior controller did not file last year’s Form 990 tax return and the IRS wants $100 per day in penalties. The letter also says if the amount is not paid then the IRS will put a lien on our assets!!! Help!!! [click to keep reading]

Learn How to Prepare Small Nonprofit Tax Returns in Five Minutes

Raise your hand if you do your best to avoid working on nonprofit tax returns. If your hand is up then you are in the majority. Most tax partners, managers and staff avoid them like the plague.

The 990 tax forms are very different from individual and business tax returns and ask a lot of informational questions. As a result, they can absorb a lot of the firm’s time and expense. In addition, since the entity is a charity, it is likely that they will ask for rock bottom prices or ask you do to the tax return as a charitable donation.

Ok, then why does the firm do them? [click to keep reading…]

Worry Less Smile More

There are plenty of times in this blog that I am going to give long winded explanations of topics to help you to have a long and successful career in a public accounting firm’s tax department. But it is important to keep in mind that preparing tax returns is only a job.

As John Lennon once said, [click to keep reading…]

Assigning & Accepting Blame in a Public Accounting Firm’s Tax Department

Since I did my previous post on learning how to accept praise, I thought it was worth sharing how most tax departments decide who is at fault for an internal problem before looking at who actually did anything wrong. Although tax accountants tend to be very law and order oriented (its one of the reasons we don’t get selected for jury duty), we hate to get blamed for doing something wrong. [click to keep reading…]

Since I did my previous post on learning how to accept praise, I thought it was worth sharing how most tax departments decide who is at fault for an internal problem before looking at who actually did anything wrong. Although tax accountants tend to be very law and order oriented (its one of the reasons we don’t get selected for jury duty), we hate to get blamed for doing something wrong. [click to keep reading…]

Advice for Tax Accountants: How to Accept Praise

This topic seems like a simple one. But tax CPAs (auditors seem to have less trouble with this one) are terrible at accepting praise. We are so trained by our conversations with clients (and the public accounting profession) to qualify every sentence that we always see the glass as half empty instead of half full. Therefore, when tax accountants finally do get praised for something they tend to do one of the following: [click to keep reading]

This topic seems like a simple one. But tax CPAs (auditors seem to have less trouble with this one) are terrible at accepting praise. We are so trained by our conversations with clients (and the public accounting profession) to qualify every sentence that we always see the glass as half empty instead of half full. Therefore, when tax accountants finally do get praised for something they tend to do one of the following: [click to keep reading]

Using Your Lunch Hour to Advance Your Career

Why in the world did I put lunch as a topic? It’s not that hard. You find a place outside the office to eat lunch or you eat at your desk.

Life is never that simple.

Let’s put it this way. Under normal circumstances, you will spend roughly 250 hours each year going to lunch during the work week. There are office rules as to how you spend this time. But you have a couple of choices. [click to keep reading…]

Tax Preparers & Reviewers: PLUG = GULP Spelled Backwards

Raise your hand if your client or boss has given you a set of financial statements where the balance sheet does not balance. If anyone has their hand down it must be that they only do individual tax returns (heh).

Everyone that prepares and reviews tax returns will run into situations when a client’s corporate financial statements simply do not balance. The client does not have an answer for it and you are stuck trying to make it work. [click to keep reading…]

Tax Preparers & Reviewers: Learn an Easy Time Management Trick for Tax Season E-Mails

If you are like most tax preparers and reviewers then you cringe at opening Microsoft Outlook during tax season. You spent the previous evening working overtime trying to get returns off your desk because you wanted to spend today catching up on things you need to do.

But you open your inbox and you find 20, 30 or 50 e-mails from

- clients,

- other staff,

- your boss,

- IT,

- headhunters (who want to lure you to another firm while you are frustrated), and

- others who want to take up your time. [click to keep reading…]