It’s going to happen. At some point, you or your boss is going to get the following sob story from a client.

Dear My Favorite CPA (when its starts this way you know you are in trouble – heh),

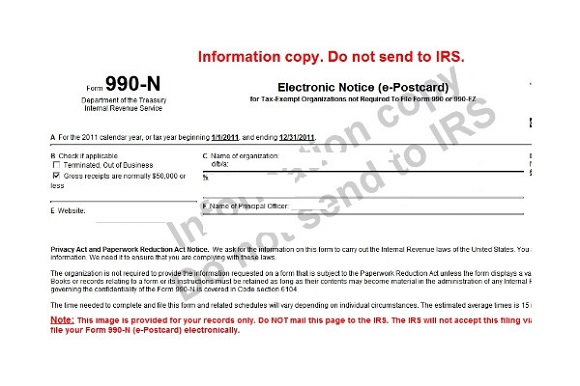

I know that you only prepare my individual and business tax returns. But I really need your help. I am on the board of directors of a charity that just got an IRS notice which says we owe them $30,000!!!

We did not discover until recently that the prior controller did not file last year’s Form 990 tax return and the IRS wants $100 per day in penalties. The letter also says if the amount is not paid then the IRS will put a lien on our assets!!! Help!!! [click to keep reading]