Raise your hand if you do your best to avoid working on nonprofit tax returns. If your hand is up then you are in the majority. Most tax partners, managers and staff avoid them like the plague.

The 990 tax forms are very different from individual and business tax returns and ask a lot of informational questions. As a result, they can absorb a lot of the firm’s time and expense. In addition, since the entity is a charity, it is likely that they will ask for rock bottom prices or ask you do to the tax return as a charitable donation.

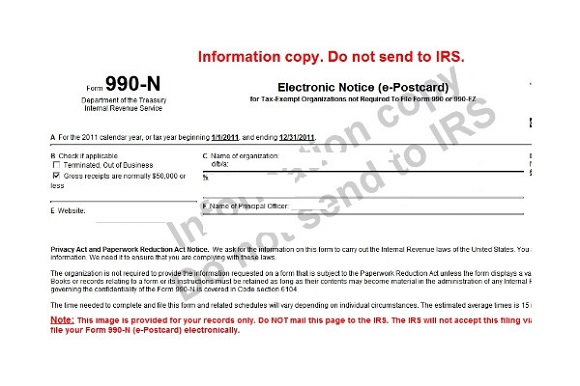

Ok, then why does the firm do them? [click to keep reading…]